Survey Insights: Preventing Financial Leakage a Top Priority

We set out to uncover challenges organizations are facing in trade spend management. To do so, a survey was conducted with 60 foodservice manufacturing organizations. This research focused on assessing their capabilities in performing preventative rebate double-dip analyses and validating distributor bill-back claims. By examining operational processes and the technologies employed, the survey revealed valuable insights into strategies manufacturers can adopt to mitigate financial leakage and optimize trade spend performance.

Key Insights from the Survey

Manufacturers often struggle to manage trade spend effectively, especially in today’s data-driven economy. The survey findings reveal critical pain points and opportunities that must be addressed.

Manual Processes and Data Inconsistency: The Top Challenges

Over 80% of surveyed participants cited manual processes and inconsistent data as their primary hurdles to effective trade spend management. These inefficiencies lead to errors, delayed reporting, and strained internal resources. Companies often rely on multiple systems, such as ERP platforms, spreadsheets, and third-party software, to manage trade spend.

Thirty-seven percent of respondents noted data inconsistencies as a challenge in validating distributor bill-back claims. These systems may use different formats, making it difficult to consolidate data accurately. Over 48% of companies report manual processes as a top challenge. Human error during manual data input is a common source of inconsistencies. Variations in how information is recorded, such as typos or incorrect categorizations, create discrepancies that ripple through the system.

Widespread Revenue Leakage Seen from Double-Dips and Invalid Claims

A lack of data standardization is a common theme. Different distributors or regions may use varying naming conventions or data structures for the same product or transaction. Inadequate tracking of critical data points, such as purchase quantities or contractual terms, can lead to incomplete records.

Over 70% of respondents expressed the need for tools that provide real-time insights into rebate validation and trade spend performance. They see accurate, timely data as a tool to foster better decision-making and stronger distributor relationships. Many manufacturers struggle with identifying and reconciling double-dip claims, leading to financial losses. Proactively flagging discrepancies can improve profitability and protect revenue.

Nearly 60% of participants stated that having a proactive solution to identify bill-back deviations and double-dips would be "extremely valuable". Without standardization, reconciling this information becomes challenging, leading to mismatches and errors. Companies need systems that offer accurate, real-time insights to make informed decisions.

Preventable Errors are Undermining Profitability

Forty-three percent of companies suspect they are overpaying on rebate programs by 1-5%, while another 16% believe the overpayment ranges between 5-10%. These overpayments stem from challenges like validating bill-back claims and addressing rebate double-dips. Some companies choose to write off minor discrepancies rather than invest in validating every claim. Over time, these write-offs accumulate, leading to substantial overpayments.

Misaligned internal processes present a significant challenge. The survey found that departments often have conflicting perspectives: Finance views the process as ineffective, while Operations perceives no issue. These misalignments create gaps in process alignment, leading to approvals based on incomplete or inaccurate data, ultimately hindering efficiency and accuracy.

Only 23% of companies perform on-demand preventative rebate double-dip analyses, leaving many vulnerable to revenue leakage. The lack of automation or robust tools increases the risk of financial discrepancies. Real-time data synchronization is rare in many trade spend systems, leading to outdated or conflicting information across platforms. For example, changes in pricing or rebate terms might not be reflected uniformly, causing inconsistencies in calculations. Overlapping programs, tiered incentives, or varying terms for different distributors make it hard to track actual liabilities. Many companies rely on periodic reconciliation rather than real-time monitoring. Without robust systems to detect anomalies, companies often fail to catch duplicate or ineligible claims.

Why is it Critical to Monitor and Prevent Rebate Double-Dipping?

In the foodservice industry, rebate double-dipping can significantly impact financial performance and operational integrity. This occurs when rebate incentives or discounts are claimed multiple times for the same purchase or transaction, leading to financial leakage and strained business relationships. Monitoring for and preventing rebate double-dips is essential for several reasons:

- Protecting Profit Margins: Double-dipping inflates rebate claims, causing manufacturers to overpay and erode profit margins. Identifying and preventing these discrepancies safeguards revenue and ensures accurate payouts.

- Maintaining Compliance: Failing to address double-dips can lead to audits, financial penalties, and reputational damage. Ensuring rebate integrity keeps manufacturers aligned with industry regulations.

- Strengthening Business Relationships: Transparent and accurate rebate processes foster trust and collaboration with distributors and operators, reducing disputes and enhancing long-term partnerships.

- Streamlining Operations: Effective monitoring eliminates inefficiencies, reducing the time and effort required for manual verification and claim reconciliation.

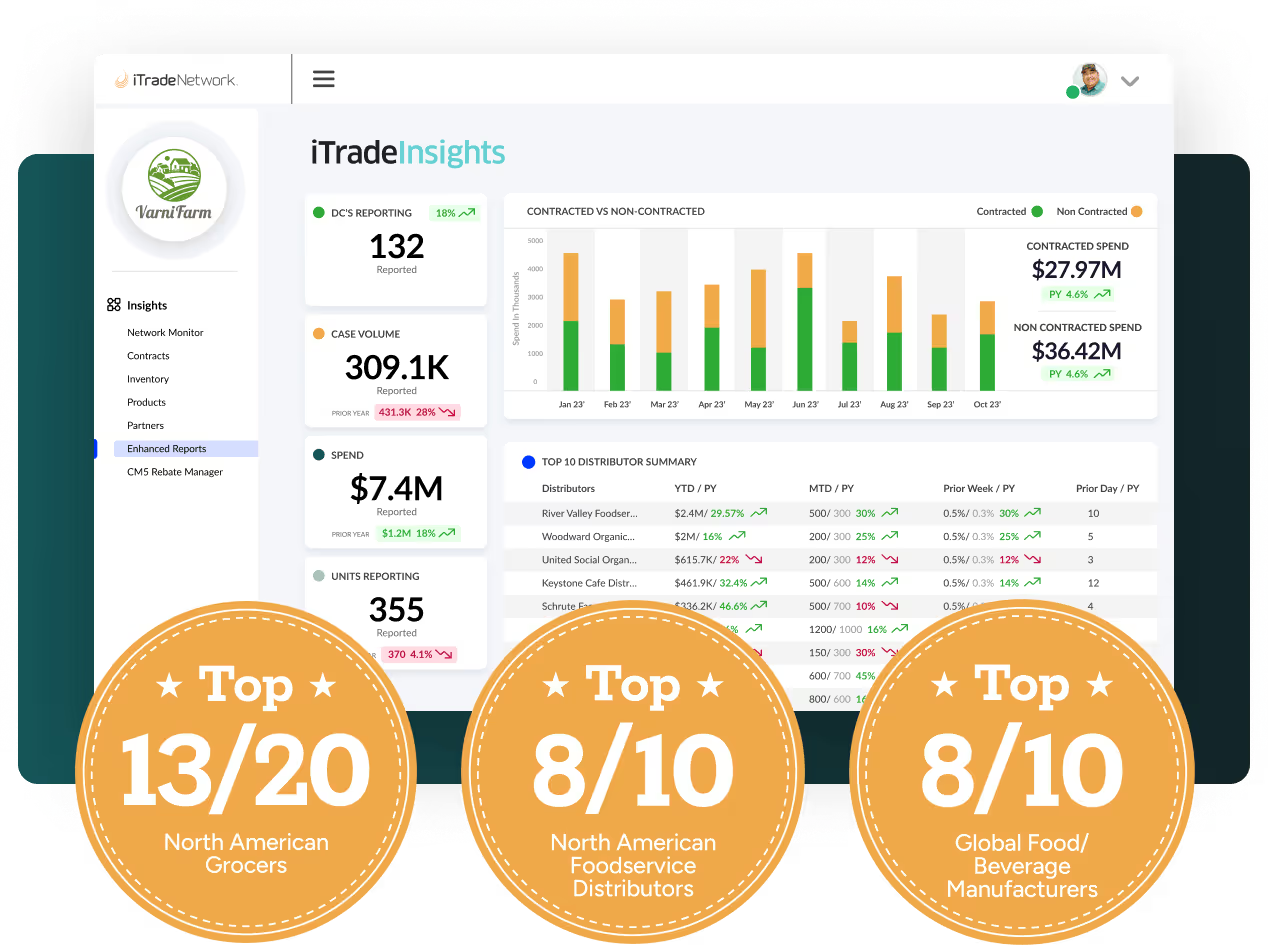

How iTradeNetwork's Solution Addresses These Challenges

iTradeNetwork’s profit & trade optimization solution addresses these challenges with precision and innovation. All while leveraging 25 years of master data expertise and the largest food and beverage supply chain network in North America. We go beyond simple file exchanges. Our Data Standardization and Enrichment Model offers a proven, hands-on solution for efficient trade spend management, enabling seamless data integration across distributors, operators, and GPOs ensuring every detail is properly mapped and integrated into your back-of-office system.

In addition to robust data standardization and enrichment, the platform improves claim transparency, making data easily accessible and customizable to unique business needs. Analysts gain actionable insights into trade dollar allocations, claim validity (eliminating potential double-dips), and trade agreement profitability.

Why Now?

With financial pressures increasing and inefficiencies persisting, the time to act is now. The research shows that companies are leaving money on the table due to outdated processes and lack of automation. iTradeNetwork’s profit & trade optimization solution is the answer, turning complex data into actionable insights, improving profitability, and safeguarding your bottom line. See the solution in action here.

Let’s work together to revolutionize your trade spend strategy. Contact us today to learn how iTradeNetwork can help you optimize spend, reduce financial leakage, and enhance profitability.

Speak to an Expert

Take a closer look at the platform built for buyers and their trading partners

Survey Insights: Preventing Financial Leakage a Top Priority

We set out to uncover challenges organizations are facing in trade spend management. To do so, a survey was conducted with 60 foodservice manufacturing organizations. This research focused on assessing their capabilities in performing preventative rebate double-dip analyses and validating distributor bill-back claims. By examining operational processes and the technologies employed, the survey revealed valuable insights into strategies manufacturers can adopt to mitigate financial leakage and optimize trade spend performance.

Key Insights from the Survey

Manufacturers often struggle to manage trade spend effectively, especially in today’s data-driven economy. The survey findings reveal critical pain points and opportunities that must be addressed.

Manual Processes and Data Inconsistency: The Top Challenges

Over 80% of surveyed participants cited manual processes and inconsistent data as their primary hurdles to effective trade spend management. These inefficiencies lead to errors, delayed reporting, and strained internal resources. Companies often rely on multiple systems, such as ERP platforms, spreadsheets, and third-party software, to manage trade spend.

Thirty-seven percent of respondents noted data inconsistencies as a challenge in validating distributor bill-back claims. These systems may use different formats, making it difficult to consolidate data accurately. Over 48% of companies report manual processes as a top challenge. Human error during manual data input is a common source of inconsistencies. Variations in how information is recorded, such as typos or incorrect categorizations, create discrepancies that ripple through the system.

Widespread Revenue Leakage Seen from Double-Dips and Invalid Claims

A lack of data standardization is a common theme. Different distributors or regions may use varying naming conventions or data structures for the same product or transaction. Inadequate tracking of critical data points, such as purchase quantities or contractual terms, can lead to incomplete records.

Over 70% of respondents expressed the need for tools that provide real-time insights into rebate validation and trade spend performance. They see accurate, timely data as a tool to foster better decision-making and stronger distributor relationships. Many manufacturers struggle with identifying and reconciling double-dip claims, leading to financial losses. Proactively flagging discrepancies can improve profitability and protect revenue.

Nearly 60% of participants stated that having a proactive solution to identify bill-back deviations and double-dips would be "extremely valuable". Without standardization, reconciling this information becomes challenging, leading to mismatches and errors. Companies need systems that offer accurate, real-time insights to make informed decisions.

Preventable Errors are Undermining Profitability

Forty-three percent of companies suspect they are overpaying on rebate programs by 1-5%, while another 16% believe the overpayment ranges between 5-10%. These overpayments stem from challenges like validating bill-back claims and addressing rebate double-dips. Some companies choose to write off minor discrepancies rather than invest in validating every claim. Over time, these write-offs accumulate, leading to substantial overpayments.

Misaligned internal processes present a significant challenge. The survey found that departments often have conflicting perspectives: Finance views the process as ineffective, while Operations perceives no issue. These misalignments create gaps in process alignment, leading to approvals based on incomplete or inaccurate data, ultimately hindering efficiency and accuracy.

Only 23% of companies perform on-demand preventative rebate double-dip analyses, leaving many vulnerable to revenue leakage. The lack of automation or robust tools increases the risk of financial discrepancies. Real-time data synchronization is rare in many trade spend systems, leading to outdated or conflicting information across platforms. For example, changes in pricing or rebate terms might not be reflected uniformly, causing inconsistencies in calculations. Overlapping programs, tiered incentives, or varying terms for different distributors make it hard to track actual liabilities. Many companies rely on periodic reconciliation rather than real-time monitoring. Without robust systems to detect anomalies, companies often fail to catch duplicate or ineligible claims.

Why is it Critical to Monitor and Prevent Rebate Double-Dipping?

In the foodservice industry, rebate double-dipping can significantly impact financial performance and operational integrity. This occurs when rebate incentives or discounts are claimed multiple times for the same purchase or transaction, leading to financial leakage and strained business relationships. Monitoring for and preventing rebate double-dips is essential for several reasons:

- Protecting Profit Margins: Double-dipping inflates rebate claims, causing manufacturers to overpay and erode profit margins. Identifying and preventing these discrepancies safeguards revenue and ensures accurate payouts.

- Maintaining Compliance: Failing to address double-dips can lead to audits, financial penalties, and reputational damage. Ensuring rebate integrity keeps manufacturers aligned with industry regulations.

- Strengthening Business Relationships: Transparent and accurate rebate processes foster trust and collaboration with distributors and operators, reducing disputes and enhancing long-term partnerships.

- Streamlining Operations: Effective monitoring eliminates inefficiencies, reducing the time and effort required for manual verification and claim reconciliation.

How iTradeNetwork's Solution Addresses These Challenges

iTradeNetwork’s profit & trade optimization solution addresses these challenges with precision and innovation. All while leveraging 25 years of master data expertise and the largest food and beverage supply chain network in North America. We go beyond simple file exchanges. Our Data Standardization and Enrichment Model offers a proven, hands-on solution for efficient trade spend management, enabling seamless data integration across distributors, operators, and GPOs ensuring every detail is properly mapped and integrated into your back-of-office system.

In addition to robust data standardization and enrichment, the platform improves claim transparency, making data easily accessible and customizable to unique business needs. Analysts gain actionable insights into trade dollar allocations, claim validity (eliminating potential double-dips), and trade agreement profitability.

Why Now?

With financial pressures increasing and inefficiencies persisting, the time to act is now. The research shows that companies are leaving money on the table due to outdated processes and lack of automation. iTradeNetwork’s profit & trade optimization solution is the answer, turning complex data into actionable insights, improving profitability, and safeguarding your bottom line. See the solution in action here.

Let’s work together to revolutionize your trade spend strategy. Contact us today to learn how iTradeNetwork can help you optimize spend, reduce financial leakage, and enhance profitability.

Unlock It Now!